Are Chinese EV Makers an Existential Threat to U.S. Legacy Automakers?

It’s remarkable that only a decade ago, the Chairman of a major Chinese state-owned automaker warned that “Chinese manufacturing presently faces the biggest crisis in its history.” At the time, China’s automakers were still struggling to catch up with their far more experienced and capable rivals from the West and Japan. Today, the script has flipped. Chinese brands are challenging the automotive world order, especially in the EV sector, where the question is no longer if Chinese firms can compete but whether legacy automakers in the U.S. and elsewhere are ready.

A Decade Ago: The Inflection Point

In 2014, China’s automotive industry was nearing a structural inflection point. Growth had slowed from an explosive 25% CAGR to a more GDP-aligned 6% range, while the product lifecycle (number of vehicles produced) and industry lifecycle (number of independent automakers) were beginning to decouple. As a result, overcapacity was rising - along with mounting pressure on margins and costs - and competitive dynamics were shifting.

At the same time, demand was bifurcating between Tier 1 and lower-tier cities. In higher-tier cities, saturation and wealth effects led to slower growth and a shift toward premium and replacement vehicles. In contrast, lower-tier cities saw continued growth from first-time buyers. Regional fragmentation in consumer preferences, combined with a shift from compact cars to SUVs, suggested the need for dual business models and multi-brand portfolios. Success would require stronger regional marketing and sales capabilities.

As the market matured, profit pools began to shift. Used vehicles from higher-tier cities started cannibalizing new vehicle demand in lower-tier regions. The aftermarket was emerging as a critical source of profitability, though its most lucrative segments risked being captured by independent players and global suppliers. Increasingly, lease and finance products were becoming essential sales enablers, especially for younger consumers.

Altogether, the business model was evolving from a “hunter-gatherer” paradigm focused solely on new car sales to a “seed-harvest” model. In this new context, capabilities such as cross-selling, used vehicle management, and aftermarket service and parts became essential. Retailers and dealers, in turn, would require far more robust OEM support.

Perhaps the most radical notion at the time was that some Chinese automakers could become global category killers following a five-stage process: gain domestic dominance, leverage cost advantages, drive innovation through relentless cost focus, expand internationally, and move up-market via R&D and strategic partnerships. To many industry executives, this sounded fanciful. A decade later, it’s clear that’s exactly what has happened.

From Doubt to Dominance: The Rise of BYD

By 2025, several Chinese automakers, most notably BYD, have indeed emerged as formidable global competitors. Originally a battery maker, BYD has become the world’s leading EV manufacturer. A 2023 UBS teardown of the BYD Seal - a sleek, high-performance sedan - revealed not only a vehicle superior in build quality to its Western rivals but also up to 25% cheaper to produce.

BYD’s growing portfolio includes budget-friendly models such as the Seagull (under $12,000) and Dolphin, as well as larger electric SUVs like the Song and Tang. These models deliver a compelling mix of value, design, and performance - qualities that are resonating well beyond China’s borders.

To support its global ambitions, BYD is aggressively localizing supply chains, manufacturing, and talent. Its four existing overseas knock-down (KD) plants each exceed 40% localization rates. New facilities in India, Turkey, and Mexico are expected to surpass that benchmark.

However, caveats remain. BYD’s core strengths - agility, vertical integration, and risk tolerance - are deeply embedded in China’s business ecosystem. Whether these advantages will translate abroad remains uncertain. Challenges around brand management, regulatory hurdles, and geopolitical tensions could all slow the company’s advance. And then there are questions regarding the firm’s financial health, including speculation that it might even be the next Evergrande. Still, the parallels with the rise of Japanese automakers in the 1980s are striking: a new competitor, operating on a different productivity frontier, is resetting global expectations.

Strategic Thresholds: Will the Threat Materialize?

Whether Chinese EV manufacturers represent an existential threat to U.S. legacy automakers hinges on two key variables: the pace of EV adoption in the U.S. and the degree of market access available to Chinese firms.

EV Uptake and the Adoption Chasm

The U.S. EV market is currently experiencing a familiar phenomenon in technology adoption: the “chasm” between early adopters and the early majority. Sales have slowed as the latter group - who prioritize cost, convenience, and reliability - remains unconvinced. These adoption “saddles” are common, often lasting several years and delaying mass-market penetration. It remains to be seen whether EVs will fully replace internal combustion engine (ICE) vehicles, or whether the market will segment into a mix of powertrains based on region, duty cycle, and use case.

Market Access: The New Gatekeeper

At the same time, Chinese automakers face significant headwinds in entering the U.S. market. From tariffs to national security concerns, the political environment is increasingly adversarial. Yet Chinese OEMs are not standing still. Mexico is emerging as a strategic beachhead.

By leveraging USMCA trade protections, Chinese automakers are building capacity in Mexico to potentially target under-served white space at the bottom end of the U.S. market, namely ICE passenger cars and trucks priced below $30,000. This strategy allows them to build local credibility, scale operations, and establish cost advantages before launching a full EV offensive when market conditions permit.

In this context, Mexico may become the Omaha Beach - only in reverse - for U.S. legacy automakers: the critical point of Chinese market entry for a much larger strategic incursion.

Four Strategic Futures: Scenarios for 2035

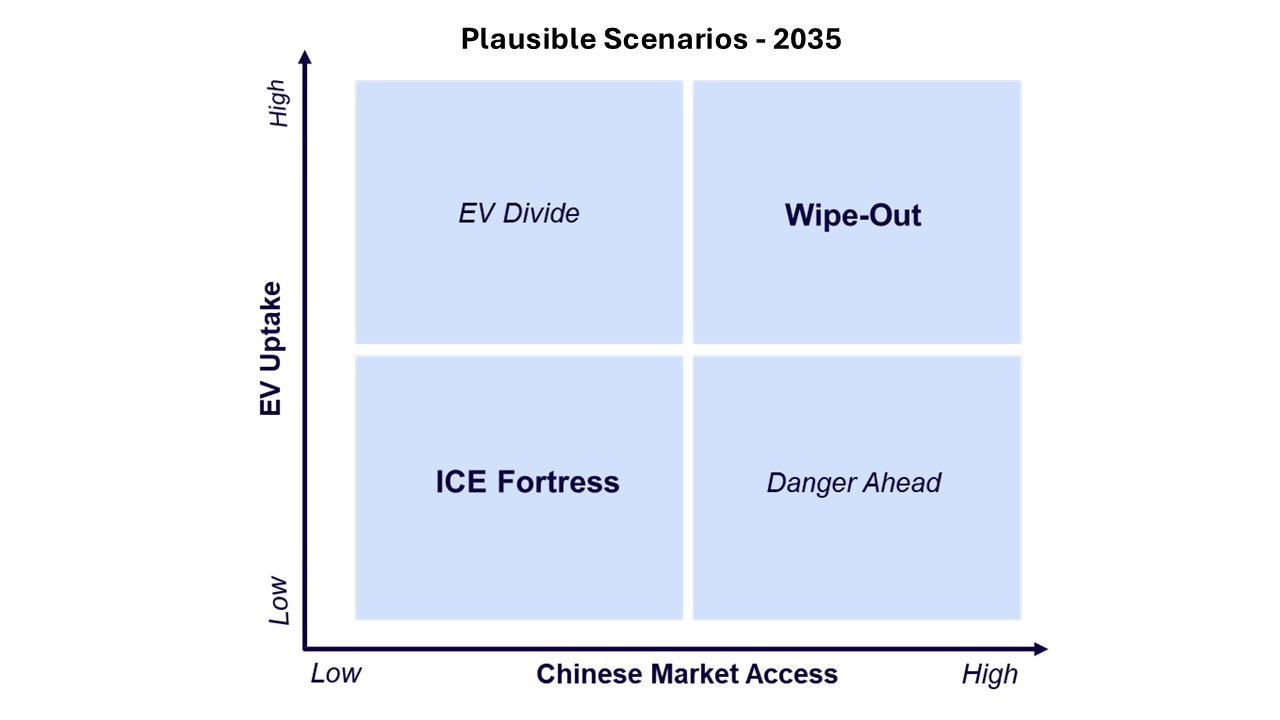

Plotting EV adoption against Chinese market access yields four plausible future scenarios:

ICE Fortress (Low EV Uptake, Low China Access)

EV policy rolls back. Chinese OEMs are blocked. The D3 double down on ICE and hybrids but risk falling behind globally.EV Divide (High EV Uptake, Low China Access)

Coastal markets go electric. Interior markets lag. Chinese firms are kept out, but the D3 face intense competition from Tesla and European brands.Danger Ahead (Low EV Uptake, High China Access)

Chinese OEMs gain entry via Mexico and Latin America, starting with ICE and hybrids. U.S. firms are caught off guard.Wipe-Out (High EV Uptake, High China Access)

The existential scenario. Chinese EVs enter at scale, outcompete on cost and tech, and overwhelm unprepared U.S. incumbents.

Strategic Postures: How the D3 Can Defend

U.S. automakers must first ask: are Chinese advantages - vertical integration, speed, digital ecosystems - replicable abroad, or context-specific? If not easily transferable, opportunities exist to slow or neutralize the threat.

Key strategies include leveling the playing field through local sourcing mandates, supply chain requirements, and regulatory alignment and/or exploring joint ventures, akin to the 50:50 JVs China itself once required, to control critical assets like distribution, areas where Chinese OEMs are weakest. Export restrictions should probably be avoided as they merely delay instead of solving competitive deficiencies.

Meanwhile, the competitive landscape in China is shifting fast. Should Chinese OEMs consolidate through friendly M&A over the next 3–4 years, they will likely accelerate global expansion. Early collaborations - e.g., VW with XPeng or Nissan with Dongfeng - suggest a potentially viable “In China for Global” model that may offer U.S. firms a fast-track to innovation and scale, if they’re willing to engage.

The Road Ahead: A Ticking Clock

Chinese EV makers are not yet dominant in the U.S., but the threat is no longer theoretical. With the right combination of consumer tailwinds, policy changes, and supply chain momentum, they could trigger an industry-wide upheaval.

The imperative for U.S. automakers is clear: don’t wait. Anticipate. Test scenarios. Partner smartly. Most of all, defend North American ground - especially in Mexico - decisively and early.

The next chapter of the automotive industry is being written now. The question isn’t whether Chinese EVs will come. It’s whether the U.S. auto industry will be ready when they do.

Sources

“How Did China Leapfrog Everyone in EVs?” Jullens and Robinson, ww.csuitenewsletter.com, 11 August 2023

“How Emerging Giants Can Take on the World,” Jullens, Harvard Business Review, December 2013

Jullens, “Extended China Board Meeting” presentation for a global automotive supplier, Shanghai, 18 April 2014

“The Electric Vehicle Slowdown: A Lesson in Technology Diffusion and Saddle Patterns,” Jullens and Robinson, www.csuitenewsletter.com, 24 August 2024

“Turbulence Ahead: US-China Relations in a Shifting Landscape,” Jullens and Robinson, www.csuitenewsletter.com, 14 September 2023

Will Chinese Electric Vehicles (EVs) win globally?” UBS, 7 Sep 2023